Watch VIDUR AI in Action

Built by Ex Big4 and Tier 1 Law Firm Professionals

Up-to-date Knowledge from 250+ Experts & Bharat Laws

Available on Web / App

& WhatsApp

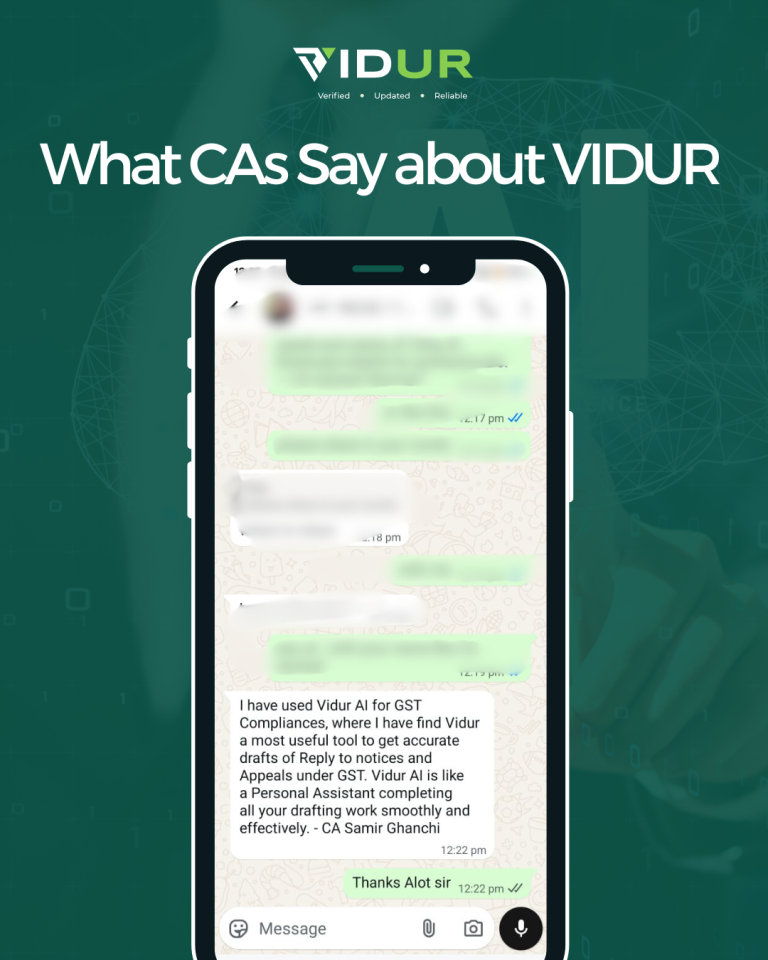

What Professionals are Saying?

Get VIDUR AI Access + Printed Book Free and master Tax, Regulatory & Corporate Laws with ease.

Secure your spot today. This is a limited time offer for the first 100 professionals who want to stay ahead in 2026.

- New Year 2026 Celebration Offer

50% OFF

Get VIDUR AI Access + Printed Book Free and Master Tax, Regulatory & Corporate Laws with ease.

What Tax & Corporate Professionals Use VIDUR for?

Ask Questions in Simple Language

“Is 194C TDS applicable on reimbursement?” → Get the exact section, applicability, and source references in seconds

Generate Drafts Faster

Board resolutions, GST notices, Income-tax grounds of appeal—auto-filled with law references and compliant formats

Track Updates

Income Tax, GST, IBC, Company law, SEBI & FEMA— all consolidated and searchable

Frequently Asked Questions

Frequently Asked Questions

How can ICAI members register on VIDUR?

ICAI members can register on Vidur by simply entering their ICAI Membership Number or their Date of Registration (e.g., MRN: 123456 or 12/10/2024).

What are the exclusive ICAI pricing plans available on VIDUR?

Vidur offers special pricing exclusively for ICAI members, designed to suit varying research needs:

Whether you're just exploring or need Unlimited access, there's a plan made for you.

Plans | Exclusive offer | No. of Queries | Validity |

Basic | Free | Unlimited | 30 Days |

Gold | 4,999 | 1500 | 365 Days |

Platinum | 9,999 | Unlimited | 365 Days |

How can I access VIDUR?

Vidur can be accessed on web (ai.vidur.in) or VIDUR App (available on Play Store and App Store) or WhatsApp (+91-8130016078).

What is the 'Prompt Library' button?

It provides pre-made question templates and practical queries to assist you in crafting questions effectively.

Does VIDUR cover laws of other countries?

Currently, VIDUR covers Indian laws with limited international laws like tax treaties, etc.

What are VIDUR Insights?

VIDUR insights are live updates created by VIDUR experts on the latest case laws, news and dynamic legal positions pertinent to corporate, tax & regulatory laws.

Is VIDUR multi-lingual?

Yes, you can get responses in any language.

Can VIDUR assist with drafting emails, summaries, blogs, etc.?

Yes, Vidur can assist in a variety of tasks such as email drafting, summarisation, tabular comparison, drafting notices, etc.

Can I access full books or commentaries via VIDUR?

No, only the relevant sections of books are accessible.For other requests, please reach out to us on our contact us page.

How frequently is VIDUR updated?

Vidur is updated on a real time basis with key case laws, notifications, circulars and other analytical insights under its domain laws.